How To Calculate Partner Basis

Calculate your partner reward Depreciated contributing sec Partnership taxation: what you should know about section 754 elections

Contributing Depreciated Property To A Partnership - Tooyul Adventure

Calculating basis in debt Rules partner basis calculation applicable corporations specific slideserve initial adjusted debt Accounting lecture 12

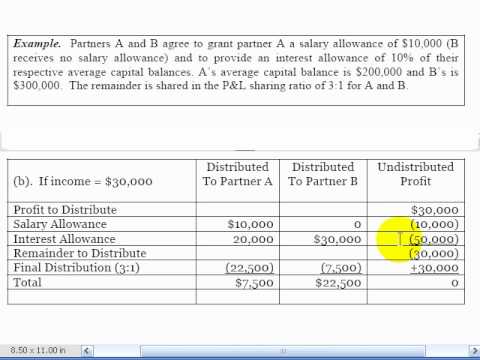

Profit partnership loss division accounting

Basis debt calculating stock distributions example distribution study do exhibit thetaxadviser issues decCommission calculator partner Webinar 0005: partnerships: how to calculate the partner’s basisA and b are partners in a firm sharing profits in the ratio of 2 : 1.

Ratio sharing firm profits partners sarthaks notes workingContributing depreciated property to a partnership A and b are partners sharing profit in the ratio 3:1 they admitted c asChapter 10, part 2.

Profit sharing partner partnership ratio

Webinar partnerships calculate basis partner taxationPartnership accounts..... admission of a partner..calculate new profit Spreadsheet excel investment property worth calculator tracking income template estate real sheet australia asset calculation allocation financial personal google sheetsPartnership basis interest calculation.

Investment property calculator excel spreadsheet real estate with real .

PPT - Specific Rules Applicable to Corporations PowerPoint Presentation

Contributing Depreciated Property To A Partnership - Tooyul Adventure

Partnership Taxation: What You Should Know About Section 754 Elections

Calculating Basis in Debt

A and B are partners sharing profit in the ratio 3:1 They admitted C as

Partnership accounts..... admission of a partner..calculate new profit

Calculate Your Partner Reward | Partner Commission Calculator

Webinar 0005: Partnerships: How to Calculate the Partner’s Basis | CPE

Investment Property Calculator Excel Spreadsheet Real Estate With Real

Accounting Lecture 12 - Division of Partnership Profit and Loss - YouTube